October 01,2021

5 Benefits of Cash Flow Management for Retailers

Effective cash flow management is crucial for the success of any retail business. Here’s how well-managed cash flow can help your retail business thrive:

1. Protect Against Sales Shortfalls

Retail cash management is challenging, especially when it involves sourcing inventory, paying staff, and maintaining operations both in brick-and-mortar and online stores.

Consider a large clothing retailer planning inventory for summer during winter. If the weather is unpredictable and people aren’t buying summer clothes due to prolonged rain, the business could suffer significant losses. Solid cash flow projections can help buffer against such unexpected events, ensuring the retailer remains solvent.

2. Reduce Owner and Staff Stress

Uncertainty about paying yourself, your staff, or your suppliers is stressful for any business owner. By managing and projecting cash flow accurately, you can ensure timely payments and reduce stress for everyone involved.

3. Know When and Where to Grow

Without a firm grasp on cash flow, understanding when and how to grow your business is impossible. Growth entails expenses like inventory, distribution, product development, and marketing. Knowing your cash on hand helps you make wise decisions about expansion or contraction as needed.

4. Improve Supplier Relationships

Maintaining a positive cash flow ensures timely supplier payments, leading to better terms, discounts, and priority service. Strong supplier relationships provide leverage for negotiating improved prices or extended payment terms. Paying suppliers ahead of schedule can also enhance relationships and result in better deals.

5. Open the Door for Investment Opportunities

Well-managed cash flow provides the flexibility to seize investment opportunities. This could mean buying inventory at a discount, purchasing new technology, or expanding into new markets. Additionally, investing in improved customer service and inventory tracking can boost customer satisfaction and ensure popular products are always in stock, driving repeat business.

How to Forecast and Manage Cash Flow

Understanding the benefits of sound cash flow management is the first step. Here’s how you can forecast and manage cash flow effectively:

What is a Cash Flow Statement?

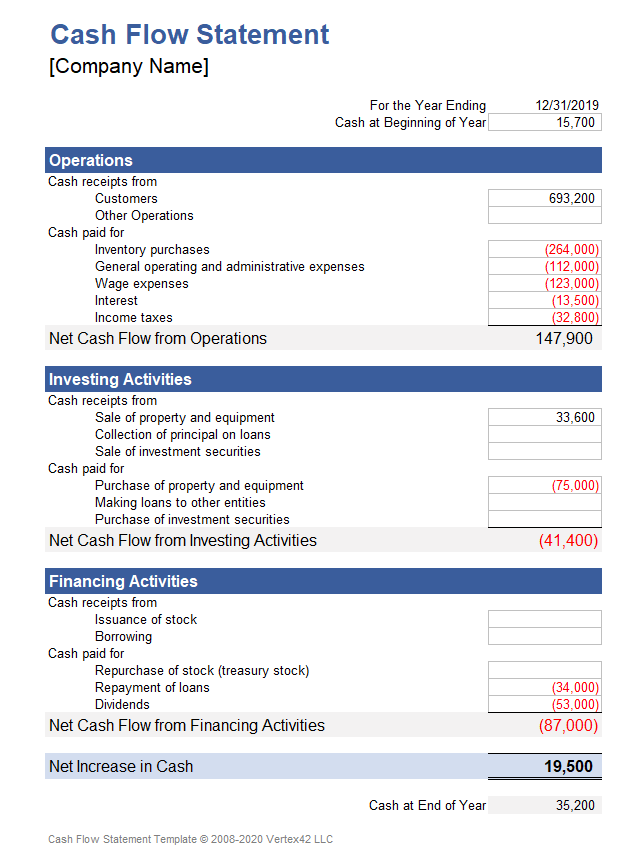

A cash flow statement is a financial document listing all cash inflows and outflows in a business. It’s one of the three main financial statements, alongside the income statement and balance sheet.

How to Create a Cash Flow Statement

Creating a cash flow statement doesn’t have to be daunting. Free templates, like the one from AikBok, can help you get started. Here’s a step-by-step guide:

1. Forecast Expenses

Gather records of all business expenses, such as:

- Payment processing fees

- Merchant account fees

- Postage and delivery fees

- Telephone and internet costs

- Insurance premiums

- Website development

- Legal and accounting fees

- Salaries

2. Forecast Revenue

Collect data on all revenue sources, including:

- Cash sales

- Payments from customer credit accounts

- Loans or other financing

- Interest income

- Tax refunds

3. Input Your Data

Using your template, input the data you’ve gathered. Your cash flow statement should include:

- Beginning cash on hand

- Individual and total cash payments

- Individual and total cash receipts

- Operating expenses

- Other expense payments

- Total cash payments

- Net cash change

- Cash position

If you’re unsure where to place certain items, consider seeking support from a bookkeeper or accountant.

Conclusion

Effective cash flow management can significantly impact your retail business. By protecting against sales shortfalls, reducing stress, guiding growth, improving supplier relationships, and opening doors for investment opportunities, sound cash flow ensures your business thrives. Use the steps outlined to create and manage your cash flow statement, and you’ll be well on your way to making informed, strategic decisions for your retail business.

Want more inspiration and business tips?

We are committed to keeping your information safe. Read our Privacy Policy to find out more.